Fetch Series Data from FRED Sever in Python: take S&P 500 price index

Python pyfredapi

I ever tried to fetch series data from FRED (Federal Reserve Economic Data) server using MATLAB1, and in this post, I’m going to learn how to do so with the help of pyfredapi23 package in Python.

First, install pyfredapi by:

1

pip install pyfredapi

Different from MATLAB fred function, an API key must be specified when fetching data from FRED server2 by pyfredapi functions. So, we should register an account4 at first and then apply for an API key.

Next, as for how to use API key, pyfredapi package provides two ways2:

You can set your API key in two ways:

- set your API key to the environment variable

FRED_API_KEY(specify in~/.zshrc,~/.bashrcfile) - pass it to the

api_keyparameter of the request function

For the first one, files zshrc and bashrc seem not compatible with Windows systems. So, as will be shown below, I adopt the second way. And, for the sake of confidentiality, I will use <my_api_key> to implicitly represent my own API key.

Then, let’s take S&P 500 price index to look at those fundamental pyfredapi functions3.

pyfredapi.series.get_series_info function

At first, the package provides pyfredapi.series.get_series_info function5 to obtain series information:

You can query a series’ information directly with get_series_info. The get_series_info function returns a SeriesInfo object that contains all the metadata for the given series.2

For example:

1

2

3

4

5

6

7

8

import pyfredapi as pf

from rich import print as rprint

from rich.pretty import pprint

SP500_info = pf.get_series_info(series_id="SP500", api_key="<my_api_key>")

# Using rich to pretty print the SeriesInfo

rprint(SP500_info)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

SeriesInfo(

id='SP500',

realtime_start='2024-08-04',

realtime_end='2024-08-04',

title='S&P 500',

observation_start='2014-08-04',

observation_end='2024-08-02',

frequency='Daily, Close',

frequency_short='D',

units='Index',

units_short='Index',

seasonal_adjustment='Not Seasonally Adjusted',

seasonal_adjustment_short='NSA',

last_updated='2024-08-02 19:57:09-05',

popularity=83,

notes='The observations for the S&P 500 represent the daily index value at market close. The market typically

closes at 4 PM ET, except for holidays when it sometimes closes early.\r\n\r\nThe Federal Reserve Bank of St. Louis

and S&P Dow Jones Indices LLC have reached a new agreement on the use of Standard & Poors and Dow Jones Averages

series in FRED. FRED and its associated services will include 10 years of daily history for Standard & Poors and

Dow Jones Averages series.\r\n\r\nThe S&P 500 is regarded as a gauge of the large cap U.S. equities market. The

index includes 500 leading companies in leading industries of the U.S. economy, which are publicly held on either

the NYSE or NASDAQ, and covers 75% of U.S. equities. Since this is a price index and not a total return index, the

S&P 500 index here does not contain dividends.\r\n\r\nCopyright © 2016, S&P Dow Jones Indices LLC. All rights

reserved. Reproduction of S&P 500 in any form is prohibited except with the prior written permission of S&P Dow

Jones Indices LLC ("S&P"). S&P does not guarantee the accuracy, adequacy, completeness or availability of any

information and is not responsible for any errors or omissions, regardless of the cause or for the results obtained

from the use of such information. S&P DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT

LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall S&P be

liable for any direct, indirect, special or consequential damages, costs, expenses, legal fees, or losses

(including lost income or lost profit and opportunity costs) in connection with subscriber\'s or others\' use of

S&P 500.\r\n\r\nPermission to reproduce S&P 500 can be requested from index_services@spdji.com. More contact

details are available here (http://us.spindices.com/contact-us), including phone numbers for all regional offices.'

)

SP500_info is a pyfredapi.series.SeriesInfo type object:

1

type(SP500_info)

1

pyfredapi.series.SeriesInfo

and we can use . operator to get value of particular attribute, for example:

1

print("id:", SP500_info.id, "\nfrequency:", SP500_info.frequency)

1

2

id: SP500

frequency: Daily, Close

Here are all available attributes and methods of pyfredapi.series.SeriesInfo object:

1

dir(SP500_info)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

['Config',

'__abstractmethods__',

'__annotations__',

'__class__',

'__class_vars__',

'__config__',

'__custom_root_type__',

'__delattr__',

'__dict__',

'__dir__',

'__doc__',

'__eq__',

'__exclude_fields__',

'__fields__',

'__fields_set__',

'__format__',

'__ge__',

'__get_validators__',

'__getattribute__',

'__getstate__',

'__gt__',

'__hash__',

'__include_fields__',

'__init__',

'__init_subclass__',

'__iter__',

'__json_encoder__',

'__le__',

'__lt__',

'__module__',

'__ne__',

'__new__',

'__post_root_validators__',

'__pre_root_validators__',

'__pretty__',

'__private_attributes__',

'__reduce__',

'__reduce_ex__',

'__repr__',

'__repr_args__',

'__repr_name__',

'__repr_str__',

'__rich_repr__',

'__schema_cache__',

'__setattr__',

'__setstate__',

'__signature__',

'__sizeof__',

'__slots__',

'__str__',

'__subclasshook__',

'__try_update_forward_refs__',

'__validators__',

'_abc_impl',

'_base_url',

'_calculate_keys',

'_copy_and_set_values',

'_decompose_class',

'_enforce_dict_if_root',

'_get_value',

'_init_private_attributes',

'_iter',

'construct',

'copy',

'dict',

'frequency',

'frequency_short',

'from_orm',

'id',

'json',

'last_updated',

'notes',

'observation_end',

'observation_start',

'open_url',

'parse_file',

'parse_obj',

'parse_raw',

'popularity',

'realtime_end',

'realtime_start',

'schema',

'schema_json',

'seasonal_adjustment',

'seasonal_adjustment_short',

'title',

'units',

'units_short',

'update_forward_refs',

'validate']

As shown before, pyfredapi.series.SeriesInfo objects provide an open_url method6 to “open the FRED webpage for the given series”. In this case, running SP500_info.open_url() will make browser open and jump to webpage https://fred.stlouisfed.org/series/SP500.

At the beginning, I didn’t know I should have provided an API key—I just use gdp_info = pf.get_series_info(series_id="GDP") in the script, with no API key, so I had an error:

1

2

3

4

5

6

7

8

9

10

11

12

---------------------------------------------------------------------------

APIKeyNotFound Traceback (most recent call last)

Cell In[8], line 5

2 from rich import print as rprint

3 from rich.pretty import pprint

----> 5 gdp_info = pf.get_series_info(series_id="GDP")

7 # Using rich to pretty print the SeriesInfo

8 rprint(gdp_info)

...

APIKeyNotFound: API key not found. Either set a FRED_API_KEY environment variable or pass your API key to the `api_key` parameter.

Look out this point.

The script is basically the same as the official example in3, and in which a Python package rich is imported. It is to display “rich text and beautiful formatting in the terminal.”7 In this case, rich.print makes print information more readable and colorful (at least in Jupyter Notebook).

pyfredapi.series.get_series function

pyfredapi.get_series_info is to obtain particular series information via API, and pyfredapi.series.get_series8 is to fetch corresponding series data:

Parameters

-

series_id: Series id of interest. -

api_key=None: FRED API key. Defaults to None. If None, will search for FRED_API_KEY in environment variables. -

return_format='pandas': Define how to return the response. Must be either ‘json’ or ‘pandas’. Defaults to ‘pandas’. -

kwargs: dict, (optional): Additional parameters to FRED APIseries/observationsendpoint. Refer to the FRED documentation for a list of all possible parameters.

Returns

- Either a dictionary representing the json response or a pandas dataframe.

Return type

dict | pd.DataFrame

For example:

1

2

SP500_df = pf.get_series(series_id="SP500", api_key="<my_api_key>")

SP500_df.tail()

| realtime_start | realtime_end | date | value | |

|---|---|---|---|---|

| 2605 | 2024-08-02 | 2024-08-02 | 2024-07-29 | 5463.54 |

| 2606 | 2024-08-02 | 2024-08-02 | 2024-07-30 | 5436.44 |

| 2607 | 2024-08-02 | 2024-08-02 | 2024-07-31 | 5522.30 |

| 2608 | 2024-08-02 | 2024-08-02 | 2024-08-01 | 5446.68 |

| 2609 | 2024-08-02 | 2024-08-02 | 2024-08-02 | 5346.56 |

where SP500_df is a Pandas DataFrame object:

1

type(SP500_df)

1

pandas.core.frame.DataFrame

and data type of each column is:

1

SP500_df.dtypes

1

2

3

4

5

realtime_start object

realtime_end object

date datetime64[ns]

value float64

dtype: object

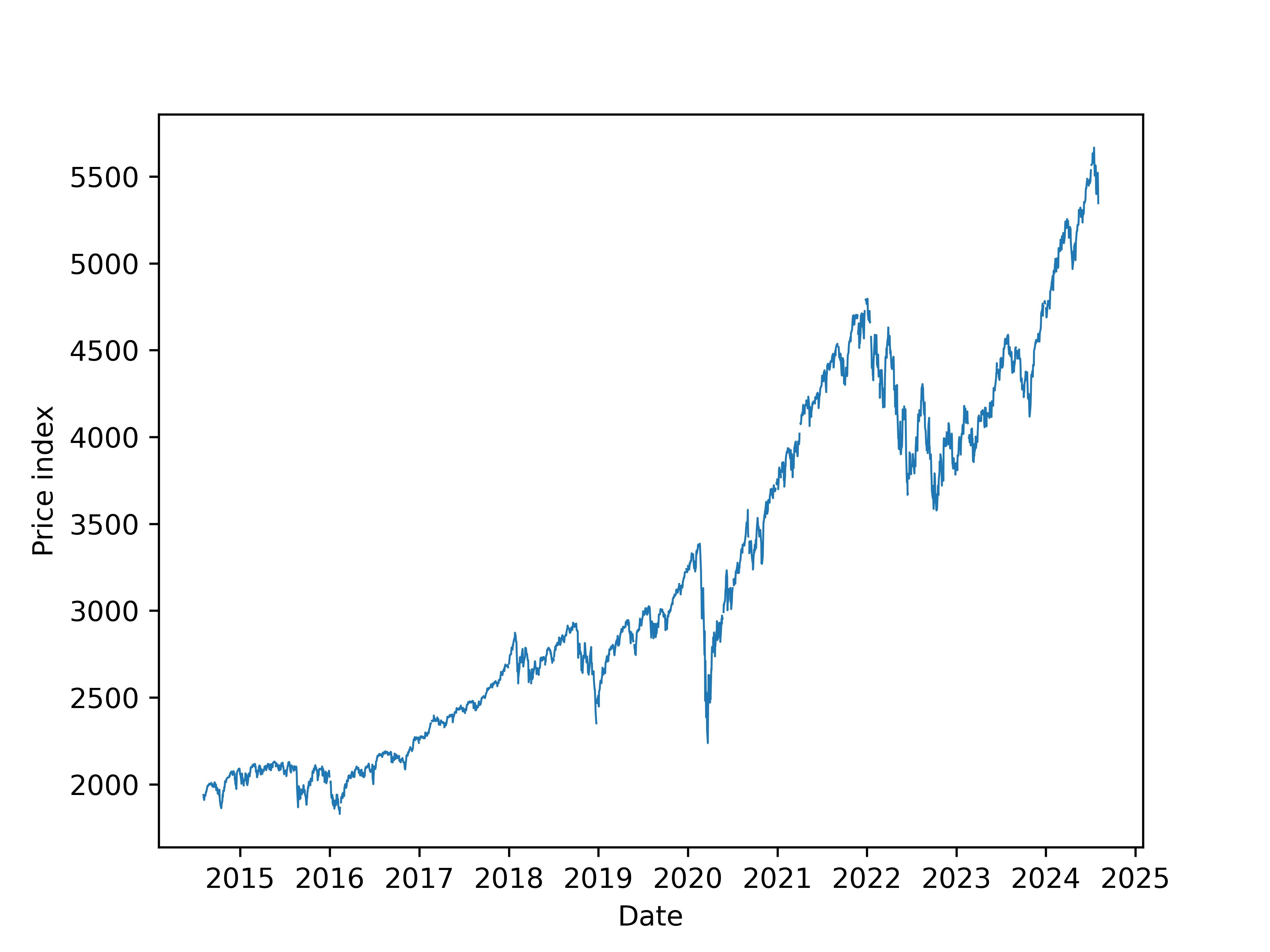

We can visualize how S&P 500 price index changes as date:

1

2

3

4

5

6

7

import matplotlib.pyplot as plt

%config InlineBackend.figure_format = 'svg'

plt.plot(SP500_df['date'], SP500_df['value'], linewidth=0.7)

plt.xlabel('Date')

plt.ylabel('Price index')

plt.savefig("fig-1.jpg", dpi=600)

As in the introduction to get_series, besides Pandas DataFrame, we can also choose to return series data in JSON format, that is:

1

2

sp500_json = pf.get_series(series_id="SP500", api_key="<my_api_key>", return_format='json')

pprint(sp500_json, max_length=5)

1

2

3

4

5

6

7

8

[

│ {'realtime_start': '2024-08-02', 'realtime_end': '2024-08-02', 'date': '2014-08-04', 'value': '1938.99'},

│ {'realtime_start': '2024-08-02', 'realtime_end': '2024-08-02', 'date': '2014-08-05', 'value': '1920.21'},

│ {'realtime_start': '2024-08-02', 'realtime_end': '2024-08-02', 'date': '2014-08-06', 'value': '1920.24'},

│ {'realtime_start': '2024-08-02', 'realtime_end': '2024-08-02', 'date': '2014-08-07', 'value': '1909.57'},

│ {'realtime_start': '2024-08-02', 'realtime_end': '2024-08-02', 'date': '2014-08-08', 'value': '1931.59'},

│ ... +2605

]

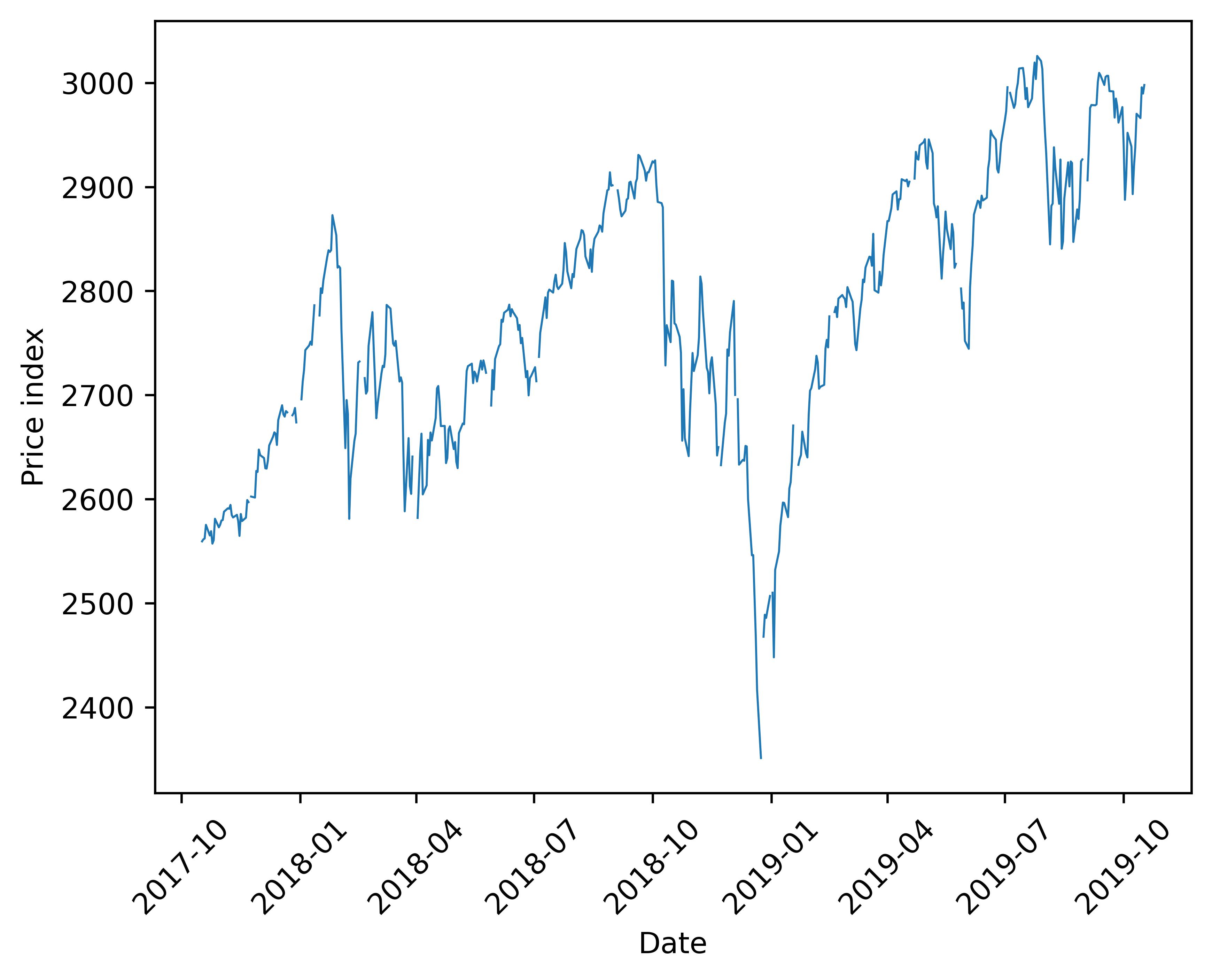

In addition, we can specify series time range (if available), for example:

1

2

3

4

5

6

7

SP500_df = pf.get_series(series_id="SP500", api_key="<my_api_key>",

observation_start='2017-10-17', observation_end='2019-10-17')

plt.plot(SP500_df['date'], SP500_df['value'], linewidth=0.7)

plt.xlabel('Date')

plt.ylabel('Price index')

plt.xticks(rotation=45)

plt.savefig("fig-2.jpg", dpi=600, bbox_inches='tight')

In this case, observation_start and observation_end are “Additional parameters to FRED API series/observations endpoint” as said in the introduction. Besides the two, more parameters can be found in FRED documentation9. In addition, FRED API documentation10 is really informative.

Archival series data: ALFRED

No matter in blog1 or in above practice, the series I fetch is FRED data. During the learning process, I found another kind of series provided, i.e. ALFRED, which is the archived version of FRED:

ALFRED®11

ALFRED® stands for Archival Federal Reserve Economic Data. ALFRED® archives FRED® data by adding the real-time period when values were originally released and later revised. For instance on February 2, 1990, the US Bureau of Labor Statistics reported the US unemployment rate for the month of January, 1990 as 5.3 percent. Over 6 years later on March 8, 1996, the US unemployment rate for the same month January, 1990 was revised to 5.4 percent.

FRED® versus ALFRED®12

Most users are interested in FRED® and not ALFRED®. In other words, most people want to know what’s the most accurate information about the past that is available today (FRED®) not what information was known on some past date in history (ALFRED®).

Note that the FRED® and ALFRED® web services use the same URLs but with different options. The default options for each URL have been chosen to make the most sense for FRED® users. In particular by default, the real-time period has been set to today’s date. ALFRED® users can change the real-time period by setting the realtime_start and realtime_end variables.

Very rigorous.

Certainly, package pyfredapi also supports accessing ALFRED data, and I’ll get into it in the future if necessary.

References